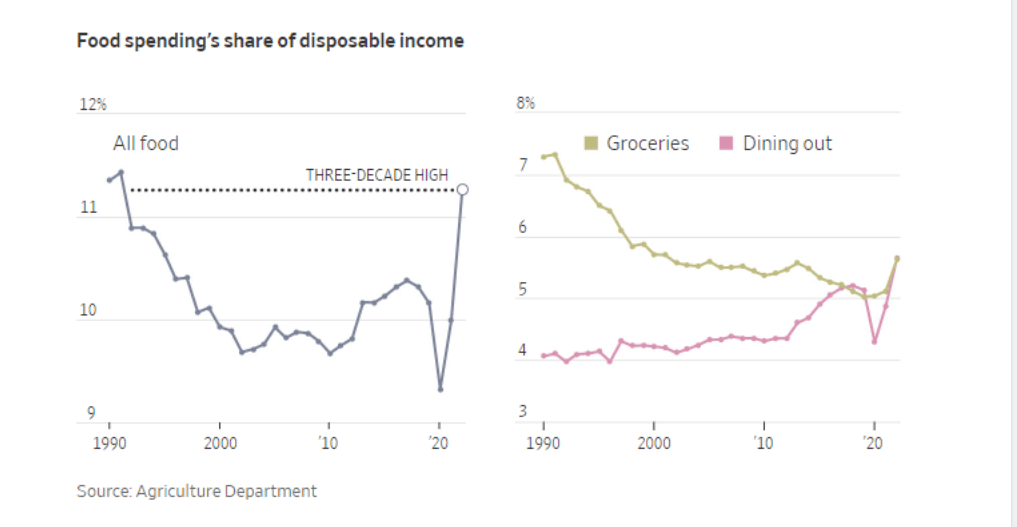

From 2019 to 2023, the all-food Consumer Price Index (CPI) rose by 25.0 percent—a higher increase than the all-items CPI, which grew 19.2 percent over the same period. Food price increases were below the 27.1-percent increase in transportation costs, but they rose faster than housing, medical care, and all other major categories. Food price increases in 2020–21 were largely driven by shifting consumption patterns and supply chain disruptions resulting from the Coronavirus (COVID-19) pandemic. In 2022, food prices increased faster than any year since 1979, partly due to a highly pathogenic avian influenza outbreak that affected egg and poultry prices and the conflict in Ukraine which compounded other economy-wide inflationary pressures such as high energy costs. Food price growth slowed in 2023 as wholesale food prices and these other inflationary factors eased from 2022.https://www.ers.usda.gov/data-products/ag-and-food-statistics-charting-the-essentials/food-prices-and-spending/

I had just turned 65 when my contract was terminated. At the time I was working for a company that outsourced people with my skill set to companies that needed people with my skill set. I was fairly confident I would be placed with another client. During the call where I was told about the contract ending my boss asked,

“Are you going to retire or do you want to keep working?”

I was in reasonably good health and enjoying my job so I said I wanted to keep working. If my reasonably good health held up along with a willing employer I hoped to work until age 70 and defer collecting social security to achieve my maximum monthly retirement benefit. The promised 8% increase to my monthly benefit for each full year I delayed benefits beyond full retirement age was quite attractive. Plus if I expired first you know who would get this higher monthly payout until her expiration.

Well guess who’s turning 70 this year? So far, so good. And in all honesty I never factored inflation into my keep working until 70 strategy. But with most things costing more nowadays I’m twice as glad I made the decision to not retire. Now I’m crafting my work until 75 strategy. It focuses on diet, nutrition, exercise and other lifestyle issues. This is a food blog, after all.

Can you imagine how much you could save each month if you just subtracted your cellphone bill, internet, and cable/streaming subscriptions? Probably enough to cover the grocery bill and then some.

Plus, more young people have student loans than ever before, and everyone pays more for healthcare than in the past. I think this is one of the reasons higher food prices are so painful for so many households. There are so many other budgetary line items these days that an increase in grocery store prices becomes even more painful.

Inflation at the Grocery Store — https://awealthofcommonsense.com/2024/03/inflation-at-the-grocery-store/

So are you going to work work until 75? Or just work on the nutrition, diet and exercise?

I’m targeting 73, hoping for 74 and maybe, just maybe 75 but I want to hit 73 first. It’s a year to year thing for me. I’ll continue to improve my diet, nutrition and exercise whether working or retired.

Sounds like a good plan!

And when will you be writing that book?

Unfortunately no target completion date at this time. I’m working on my tendency to procrastinate first.

https://www.nature.com/articles/s41467-023-41474-5